Budgeting in Your 30s: Smart Habits That Build Wealth Over Time

Affiliate Disclosure: This article may contain affiliate links. If you purchase through them, we may earn a small commission at no extra cost to you. We only recommend resources we trust.

In your 20s, money often feels like survival mode: paying rent, juggling student loans, maybe saving a little. By your 30s, the stakes rise. Family, homes, retirement, and lifestyle upgrades all compete for dollars. The good news? Budgeting in your 30s doesn’t mean penny-pinching forever—it means creating smart systems that let wealth grow automatically over time. This guide breaks down simple, repeatable habits that work no matter your income level.

Budgeting in Your 30s: Why It Matters

Your 30s are a wealth-building decade. Time is still on your side, but responsibilities add up. Every dollar you save or invest today compounds into thousands later. Without a budget, it’s easy to drift into debt and miss opportunities.

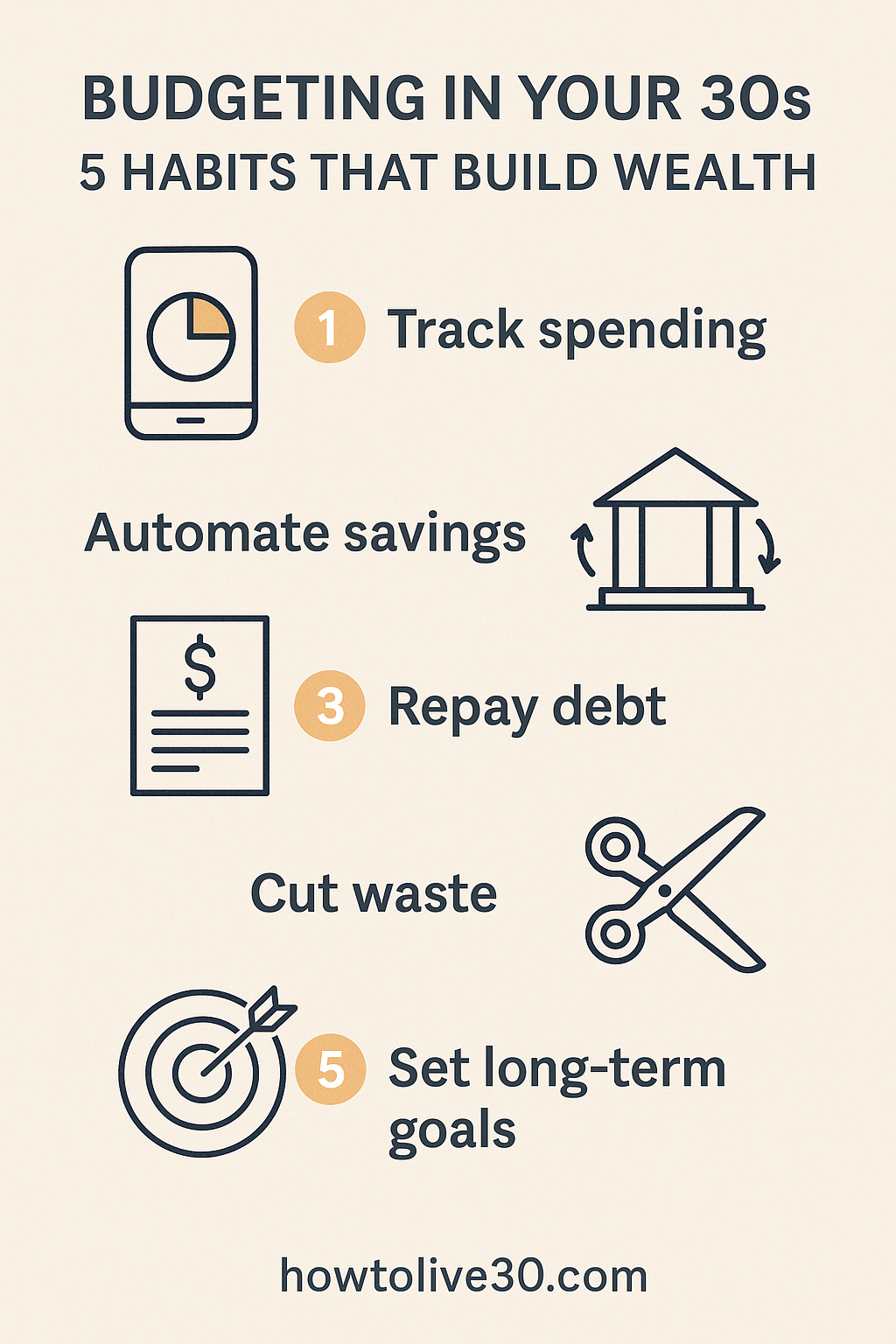

Budgeting in Your 30s: The Core Habits

- Track your spending: Awareness beats guessing. Use a simple app or spreadsheet.

- Set clear goals: Debt freedom, a home down payment, retirement, travel—your budget serves these.

- Pay yourself first: Automate savings and investments before spending.

- Cut waste: Subscriptions, fees, and impulse buys often add up to hundreds monthly.

Budgeting in Your 30s: The 50/30/20 Framework

A simple system:

- 50% needs: Housing, food, bills.

- 30% wants: Fun, travel, shopping.

- 20% savings/debt repayment: Automate this category first.

Pro Resource: Many people in their 30s automate investing into index funds. If you’re US-based, consider providers like Vanguard or Fidelity. Always research before investing and consult a financial professional for advice.

Budgeting in Your 30s: Emergency Fund First

Life happens—job loss, car repairs, health bills. Having 3–6 months of expenses in a savings account prevents debt spirals. Start with $1,000 as a mini-goal, then build steadily.

Budgeting in Your 30s: Debt Strategy

- Snowball: Pay smallest balances first for quick wins.

- Avalanche: Pay highest interest first to save money long-term.

Either works—what matters is momentum.

Budgeting in Your 30s: Automate, Automate, Automate

Set up automatic transfers for savings, investments, and bills. Removing willpower from the equation is the secret weapon of successful budgeters.

Budgeting in Your 30s: Lifestyle Inflation Check

Raises and promotions are golden opportunities—if you avoid inflating expenses. Try this: every time your income grows, save at least half of the increase before upgrading your lifestyle.

Budgeting in Your 30s: Long-Term Vision

Think beyond next month. A budget is the tool that funds future freedom—retirement, travel, a family home, or even starting a business. The habits you lock in now set up the decades ahead.

Pro tip: Review your budget once a month, not daily. The goal is sustainable systems, not obsessive tracking.

Your Next Step: Budgeting in Your 30s Made Simple

Budgeting doesn’t need to be restrictive. Start with awareness, automate the basics, and align spending with your values. Over time, budgeting in your 30s shifts from a chore to a freedom plan—because your money works for you, not the other way around.

Action Step: This week, cancel one unused subscription and redirect that money to savings. Small moves compound into real wealth.

About HowToLive30: Practical fitness, mindset, skincare, and budgeting for your best decade. We keep guides simple, science-aware, and doable.